Mark Buonaugurio

Senior Vice President - Wealth Advisor

[email protected]941.366.7222 x50617

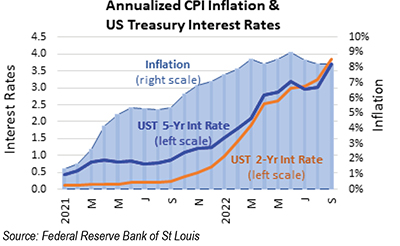

The reigniting of inflation to its highest levels in over four decades has been the catalyst

for the dramatic sell-off in stock and bond markets for the past year. Inflationary pressures

began building in early 2021 as the result of several factors: revived consumer demand in the

aftermath of the COVID shutdowns; supply chain disruptions from multiple sources; and the

excessive monetary and fiscal stimulus from multiple COVID rescue plans implemented by

the Federal Reserve and the Federal government.

In its effort to fight inflation, the Fed

raised interest rates five times so far

this year, including not one, but three

rate hikes of 75 basis points each, for

a total increase of three-percentage

points on the Fed Funds rate – the

overnight lending rate for banks. And

with inflation running hot at over

8% annualized, the Fed has clearly

signaled that it isn’t done yet. Indeed,

with interest rates having started

the year near zero, the Fed indicated that it may push its Fed Funds target up another 1.25

percentage points to about 4.5% by year-end, and possibly higher. Meanwhile, short- and long-term

interest rates began a game of “catch up,” as bond investors demanded higher yields

on fixed income assets to compensate themselves for the prospect of higher and sustained

inflation. Yields on the shortest maturities have risen most, with 2-year Treasuries yielding

more than 4% at the time of this writing.

Many analysts expected a temporary, post-COVID jump in inflation, due to pent-up demand and a normalizing of prices

following the brief deflation during COVID (recall that many prices fell as consumption collapsed in early 2020). However, the

ongoing shutdowns of overseas economies (particularly in China) have extended and worsened supply chain disruptions,

as has an unusual decline in labor supply as many workers have effectively quit the labor force, creating bottlenecks and

backlogs everywhere from restaurants to commercial shipping ports. Meanwhile, a different kind of supply disruption was

created by curtailed US oil and gas production and embargoed Russian energy supply – a global sanction for that country’s

war on Ukraine. The resulting surge in energy prices further “fueled” inflation by raising the costs of production throughout

the supply chain, from transportation to the fertilizer needed to grow global crops. Grain production was another tragic

casualty of the war in Europe, resulting in a troubling food shortage that has also had global and inflationary consequences.

It has been rightly said that inflation can be described as the result of too much money chasing too few goods. Fiscal and

monetary policy injected trillions of dollars into the US economy during the COVID crisis, and the Fed’s newfound monetary

retrenchment may help with that source of rising prices, but it can’t resolve the supply issues resulting from other factors like

war, regulatory restrictions, and lifestyle changes. Most of these may still prove to be temporary, though painfully prolonged.

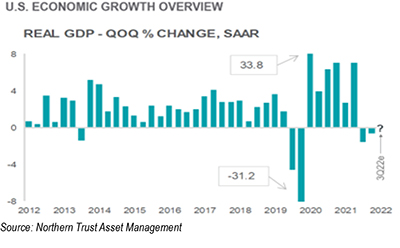

However, the Fed’s aggressive rate hikes have produced something else: a bear market in stocks. As the Fed pushes interest

rates higher, the likelihood of an economic recession also grows. By traditional measures, the US economy was officially

in recession after two quarters of contracting gross

domestic product (GDP) during the first half of the year.

GDP performance for the third quarter is uncertain, but

many analysts expect it to be soft at best. Nevertheless,

unemployment remains remarkably low at 3.5% and business

hiring remains relatively strong, though much slower than

at the start of the year – likely a product of the unusually

low labor force participation rate. Still, a weak economy

translates into lower profits – a direct reduction of one of the

key factors supporting stock valuations. Furthermore, rising

interest rates mean that the present value of expected future

corporate earnings (now revised downward) is also lower,

exacerbating the decline in stock prices.

|

|

|

|

| S&P 500 |

-4.88% |

-23.87% |

| Russell 1000 Growth |

-3.60% |

-30.66% |

| Russell 1000 Value |

-5.62% |

-17.75% |

| Russell 2000 Value |

-4.61% |

-21.12% |

| Dow Jones US Real Estate |

-10.44% |

-29.37% |

| MSCI EAFE (net) |

-9.36% |

-27.09% |

| MSCI Emerging Markets (net) |

-11.57% |

-27.16% |

| Bloomberg U.S. Aggregate Bond |

-4.75% |

-14.61% |

| Bloomberg Municipal Bond |

-3.46% |

-12.13% |

| Bloomberg U.S. High Yield |

-0.65% |

-14.74% |

| Source: Morningstar |

As measured by equity returns through the third quarter, US

and global stocks are in a bear market, with declines of more

than 20% from their recent highs. For the first nine months

of the year, the S&P 500 declined nearly 24%. Most of those

declines came from the growth side of the market (down

more than 30%, as measured by the Russell 1000 Growth and

NASDAQ indices), where technology companies, especially,

retreated sharply. Having led the gains in stocks for much

of the past ten years, they have been leading the way lower

for most of the past twelve months. Value companies have

performed much better year-to-date – but are still down

roughly 17% for the Russell 1000 Value index and the much-watched

Dow Jones Industrials. Nevertheless, during the

third quarter, value stocks performed slightly worse than

growth companies, as fears of recession spread.

While bonds are often the beneficiaries of falling stock

prices and a “flight to quality,” that is not the case in this

market cycle, as the inflation-driven surge in interest rates

means the value of bond portfolios decline. In fact, the most

common measure of US bond market performance declined

year-to-date by nearly 15% -- only slightly better than the

performance of value stocks and the Dow.

Looking forward, investor expectations for inflation and the

trajectory of interest rates will likely remain the key drivers

of market conditions, though other factors can provide

unexpected positive or negative surprises for the market.

The midterm elections are looming, an event that often

creates market uncertainty. Many pundits anticipate a shift

in control of one or both houses of Congress. While that

could result in gridlock, the markets often respond favorably

to divided government that makes dramatic change (and,

therefore, uncertainty) less likely. The war in Ukraine, a

source of increasing worry in recent weeks, could move

things in either direction. Clearly, an early end to that conflict

would be welcome for many reasons, and especially to bring

relief to the untold human suffering that is occurring.

Uncertainties abound. Excluding the depression-era, the

average bear market for the S&P 500 has averaged about

16 months, so we may yet have more financial pain to deal

with. Even so, stock valuations generally have become

much more appealing. Some sectors of the market look very

attractive, providing opportunities for income as well future

growth. While recovery from losses in the bond market will

likely take time, recovery from stocks can come swiftly.

And the rising consumer prices that are currently battering

stocks and bonds will eventually flow through to corporate

revenues and the bottom line, meaning stocks may offer the

best long-term protection from our current bout of inflation.

That doesn’t mean we should all start buying stocks. That

decision should be considered in the context of your

personalized financial plan. Though uncertainties abound,

your CNB advisors are here to help you navigate our current

financial challenges.

Data as of 9/30/2022.

This material is provided for general information purposes only. Past performance is not indicative of future investment results. Any investment involves potential risk, including potential loss of capital. Before making any investment decision, please consult your legal, tax and financial advisors. Non-deposit investment products are not bank deposits and are not insured or guaranteed by Canandaigua National Bank & Trust or its affiliates, or any federal or state government or agency and are subject to investment risks, including possible loss of principal amount invested.